The Swiss Payslip in Brief

What deductions apply to a monthly salary of CHF 5,000 in Switzerland?

In this article, we look at a concrete example of a Swiss payslip.

Imagine you’re browsing job offers in Switzerland and you find one that matches your profile, offering a monthly salary of CHF 5,000 – equivalent today (2023) to about EUR 5,100 or USD 5,500. Compared to salaries in many other countries, that seems high.

However, the cost of living in Switzerland is also much higher than in many places. With such big numbers, it’s hard to picture what CHF 5,000 really means in practice. Let’s take the example of Mr. Martín Fulano, a 35-year-old Spanish citizen, married with one young child.

Mr. Fulano arrived in Switzerland with his wife and son in early 2023. He has a B permit, which allows him to live and work legally. With a B permit, his employer must deduct his taxes directly from his salary (withholding tax).

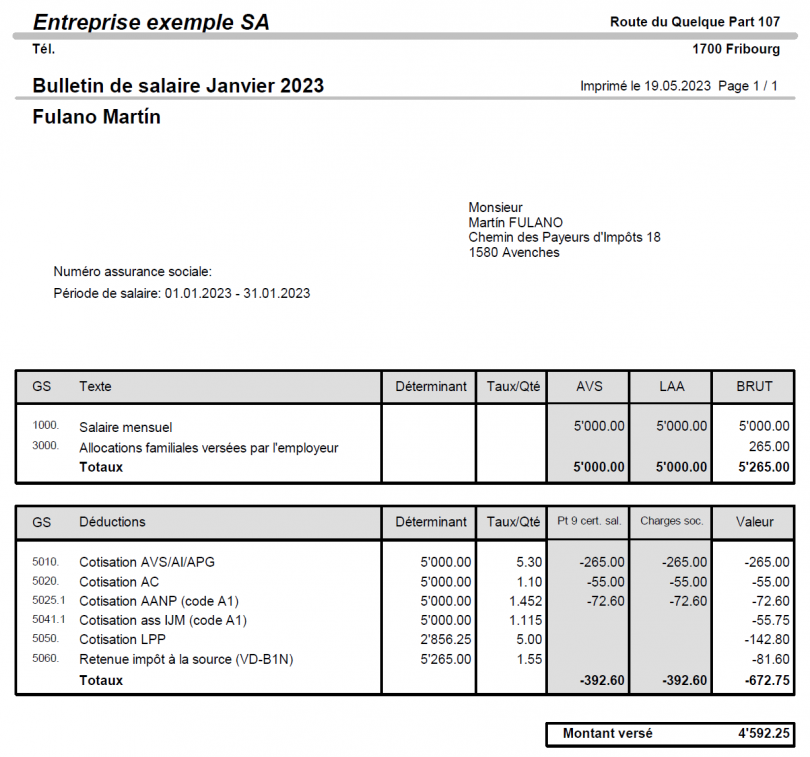

Here’s what his January 2023 payslip might look like:

We can see here the gross salary of 5,000 francs, a family allowance of 265 francs (varies from canton to canton – in this case, Fribourg), and several deductions. These deductions are mandatory; it is not possible to avoid them. In some cantons, there are special deductions not shown here, for example in Geneva, where a compulsory maternity insurance contribution is levied, ranging from 0.043% to 0.046% of the gross salary.

In all cases, here is a summary of the main deductions applicable throughout the country:

Liste des services

-

5010. Cotisation AVS/AI/APG:Liste des éléments 1

This is the first pillar of the Swiss pension system. This insurance is paid 50/50 between the employer and the employee, each paying 5.3% of the gross salary.

-

5020. Cotisation ACListe des éléments 2

AC means Unemployment Insurance. This insurance is also paid 50/50 between employer and employee, each at a rate of 1.1% of the gross salary. Thanks to this insurance, if Mr. Fulano were to lose his job, and provided he had worked for at least one year in Switzerland, he would be entitled to unemployment benefits until he found a new job. This entitlement is limited to two years, during which unemployment insurance guarantees him 70% of his salary (80% if he has children).

-

5025.1 Cotisation AANPListe des éléments 3

Swiss companies are required to insure their staff against both occupational and non-occupational accidents. They are allowed to pass the cost of non-occupational accident insurance on to their employees. This is what this deduction corresponds to. If you work at least 8 hours a week for the same employer, this insurance must be in place. It may not appear on your payslip if your employer pays for it on your behalf. The percentage depends on the contract; in this example, this insurance costs 1.452% of the gross salary.

-

5041.1 Cotisation ass IJMListe des éléments 4

This insurance is optional for companies, but if your employer has taken it out, you are required to pay half of the premium (50/50 employer/employee). This insurance covers illness cases. A recent example was COVID-19: as it is a virus, employee absences would not be covered by accident insurance but by IJM (daily sickness allowance) insurance.

-

5050. Cotisation LPP

The “LPP” is the second pillar of the Swiss pension system. In short, the employer deducts a fixed amount every month. Unlike AVS (first pillar), companies have a lot of flexibility with the LPP if they want to improve conditions for their employees. The legal minimum says that the cost must be shared equally (50/50), but it is common for companies to offer a 60/40 split in favour of employees.

Part of the percentage depends on the employee’s age (25-34: 7%, 35-44: 10%, 45-54: 15%, 55-64: 18%). The calculation base is not the full salary: the so-called “coordination deduction” of CHF 25,725 (2023) must be subtracted. In Mr. Fulano’s case: his gross annual salary is CHF 60,000, which means his LPP-insured salary is CHF 34,275 (60,000 – 25,725 = 34,275).

-

5060. Withholding tax deduction

For a person holding a B permit, tax is deducted directly from the salary. Unlike social insurances, family allowances must be included here, as they are part of the income. This is why the calculation base is CHF 5,265 instead of CHF 5,000. A person holding a C permit, or married to someone with a C permit or a Swiss passport, can request to pay taxes together with their spouse through the annual tax return and not be taxed at source. In general, the result is the same, as most cantons still require the payment of monthly tax instalments.

In the present example, it should be noted that the tax rate is extremely low (1.55%) because this is a family with one child where only the husband works. If both parents worked or if they had no children, the tax rate would be much higher. Each canton publishes withholding tax rates on its website.

After these deductions, we can see that the net salary Mr. Fulano will receive in his account is CHF 4,592.25.